From ATMS to algorithms – tech’s influence in finance

The AI revolution is coming for the financial services industry, but will it end up being a friend or foe?

In 2024, digital disruption in banking continues at top speed.

Despite a challenging macroeconomic picture, there has been a wave of technology investment in the financial services, including open banking and blockchain, but AI and particularly generative AI is taking centre stage. Described by many as the most transformational technology in our lifetimes, generative AI is largely powered by Large Language Models (LLMs), which are deep learning models trained on massive datasets. This has led to the development of intelligent user-friendly software, such as ChatGPT and Google Bard, which can create text, images and computer code with human-like ability. The latest iteration of ChatGPT (GPT4) was recently released by OpenAI, with CEO Sam Altman calling it “natively multimodal”. Meaning the model can generate content and understand commands through text, voice or images.

Alicia Ngomo Fernandez (MBA2011) Vice President, Head of Visa Consulting & Analytics (UK & Ireland, France & Belux) and AI lead for Visa in Europe, says generative AI has completely disrupted how humans interact with technology. “The capability is on a par with the disruption of the internet and the smartphone, but probably greater.”

What will this mean for the future of financial services? How will these new models be integrated into businesses, and will they serve us – or could our lives be upended by unwelcome automation and rogue algorithms?

"The intelligence revolution has been gradually transforming business operations, customer service, market insight analytics and regular people’s everyday lives"

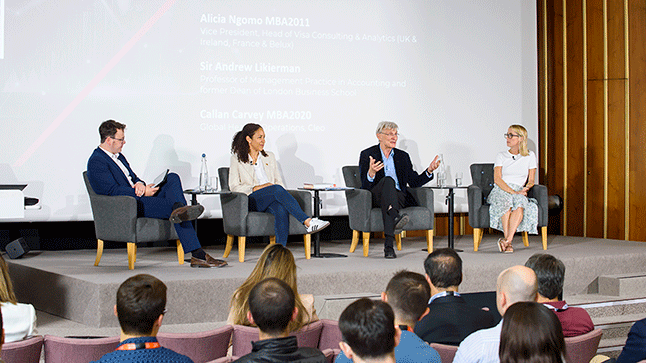

This was the topic of a lively think ahead discussion in May, where London Business School’s former dean Sir Andrew Likierman, Professor of Management Practice in Accounting at the School joined Alicia and Callan Carvey (MBA2020), Global Head of Operations at AI financial services assistant Cleo AI to assess the role of technology, particularly generative AI, on the future of financial service delivery – and what guardrails must be put in place to ensure technology is always an enabler and not a disabler.

Here are three takeaways from the event:

Accept we are in an AI-powered digital age – society must embrace the positive while understanding and dealing with the risks

The intelligence revolution has been gradually transforming business operations, customer service, market insight analytics and regular people’s everyday lives over a good number of years. Think curated music and video playlists, internet search engines, meal planning apps and low-cost wealth management tools to name just a few uses. The capacity of computing power to process ever growing volumes of data is growing exponentially and the models and algorithms that can learn from that data in order to make predictions and suggestions that can guide real-time decisions and actions are growing in sophistication. The power of LLMs, according to Goldman Sachs, is such that 300 million jobs could be lost or degraded worldwide to industrial automation.

On a positive note (if it is possible to be after the chilling prediction above), in the financial services, AI and its successor generative AI have paved the way for low-cost personalisation and customisation of banking services and financial management tools, widening access to timely financial advice for millions of people. During one of the most difficult economic periods in modern times, young people especially are feeling overwhelmed, and that their financial goals are unattainable. So, this is one AI-powered application to be broadly welcomed.

Cleo is an AI personal finance assistant which aims to help its customers, mostly young people, budget, save, avoid overdraft fees and borrow small amounts using their transaction information drawn from their bank account. Using generative AI technology, the app uses scripts provided by comedians to talk to their customers as a friend may about their spending habits. It also uses generative AI to inform new revenue generating opportunities – when to increase lending capacity and when to take repayments. It offers a groundbreaking dynamic approach to managing domestic expenditure and aims always to be protective and never predatory.

“We have four-to-five times the engagement levels of other banks and fintechs,” says Callan Carvey (MBA2020), Global Head of Operations at Cleo AI, which launched in London in 2017 before pivoting to the US. According to its website, the app has to date helped six million people. “We are seeing users' trust in Cleo is growing as they use her services more. This is also helped by the fact that we are not just hawking our own products through her, but actually trying to meet the legitimate needs of our customers through strategic partners.”

On the flip side, generative AI has opened the floodgates for bad actors to commit fraud in a number of new and complex ways. Digital identity theft and synthetic ID creation allows fraud risk to climb the value chain and those same technologies will have to be used thoughtfully to address this growing problem.

In a machine-first world, humans have an important role. What is it?

“If machines can be as good as human beings – and they will absolutely be doing more tasks that we currently do as well or better in the future – then the question must be: ‘What won’t the machine be able to do?’” Professor Likierman poses the question. The former dean of London Business School, who is a non-executive director of startup bank, Monument, has been investigating human judgement over the past few years. “What will be left for the human being to do?”

He lists some of the qualities that algorithms and neural networks don’t have. These include consciousness, intentionality, a sense of context, meaning, ethics and empathy. “They can’t anticipate spontaneity and are not good at interpreting random interactions, fluidity, nuance or contextual shifts.

"The think ahead panel discusses a near future where financial services chatbots mimic humans so closely"

“They cannot think abstractly or cope easily with ambiguity and incompleteness. They can confuse correlation with causation. I’ve done quite a lot of thinking about the question: what machines will do and what they won’t do. That does seem to be relevant,” he reflects. And in the context of financial services, he believes it means that organisations must understand they cannot outsource everything to the machines.

“Judgement will be the final frontier for AI. That is what I see,” he adds. In wealth management, Professor Likierman says humans will still be needed for their judgement – because the world is not predictable. “Humans will be vital to interpret context.”

The importance of ‘strategic friction’: the limitations of technology in securing and maintaining trust are starting to be thrashed out

While the data scientists at Cleo are continuously sharpening its AI model to solve repeat problems and ensure a smoother customer experience, Callan says that her user experience score has remained fairly static, despite the efforts. Callan believes that this is because even though a machine can solve a problem, people still want to have confirmation from a human that their problem has been solved.

Also, the machine is not always right. ChatGPT has its flaws. And for this reason, Callan says Cleo employs a good many people to annotate all the responses from her AI chatbot – to mitigate the scepticism people have about sharing private data with AI. “We believe this is vital to trust building, as well as risk management,” says Callan. She also believes that over automating will not be acceptable to financial services customers and that creating a certain amount of friction at the right times make people feel like they are still in control.

“This is why we are experimenting with different onboarding flows, different repayment mechanisms and different servicing notifications. We can add more or less friction depending on the requirement.” Alicia calls this “strategic friction”.

The think ahead panel discusses a near future where financial services chatbots mimic humans so closely it will become much more difficult – maybe impossible – to tell whether you are speaking to a human or a machine. In that new paradigm, how important will transparency be? How comfortable will people feel about that?

“I don’t think we have the answers yet,” says Alicia.

The panel agrees the technology trend will only continue to accelerate. New applications and innovations will flourish over the next few years. So, the industry, and all industries, together with governments and policy makers must be considering now how humans can coexist with the machines, each playing to their strengths.