"Exploring a wide range of projects gave me the tools to mitigate risk."

Project and Infrastructure Finance

Master the financing of infrastructure and industrial projects to add value to your organisation.

Watch programme video

Please enter a keyword and click the arrow to search the site

Or explore one of the areas below

Master the technical dynamics of investment in large-scale projects and connect with other global professionals in this unique growth industry.

Gain the confidence to successfully navigate the entire project finance process - from initial agreement to completion.

Explore successful – and unsuccessful – examples of project and infrastructure finance.

Understand what lenders are looking for and how to align their needs with yours.

Restructure projects in distress for optimal results, sharing insights with a global and highly talented cohort.

Explore project finance through real-world case studies, examining the latest industry techniques with world-leading faculty.

of professional experience

on average

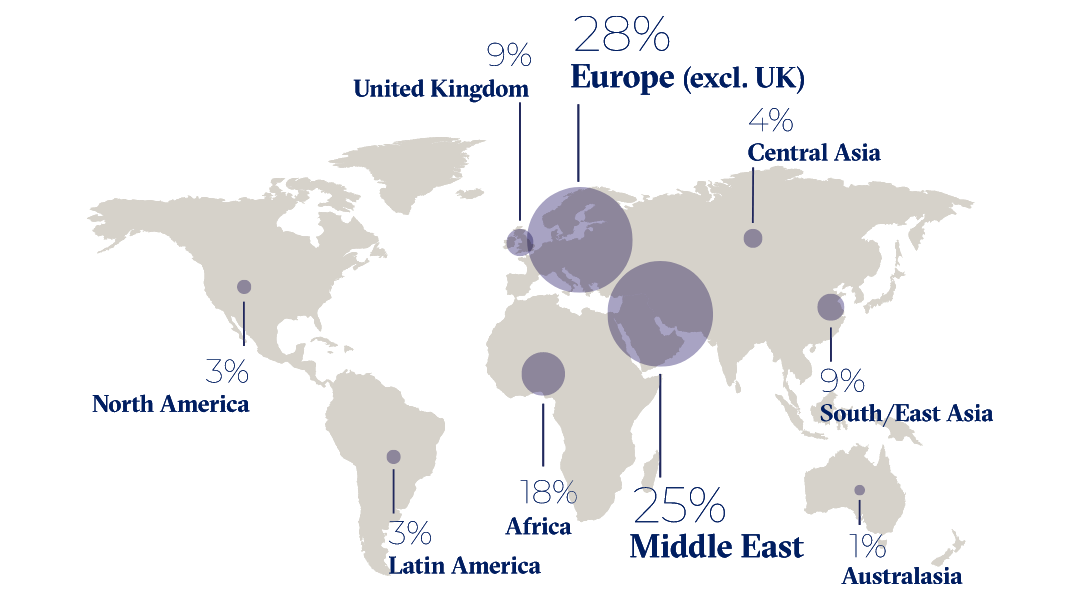

nationalities

on average per cohort

Attendees include:

Finance professionals from the private and public sectors.

Finance professionals from industries including energy, infrastructure, transportation and logistics, utilities and mining.

Government officials.

Equity investors and sponsors.

Project finance advisors within banks.

Developers, engineers, lawyers and legal advisors, auditors and risk managers.

Gain the practical skills and expertise to manage the process of valuing, financing and structuring project and infrastructure deals.

Create value through project and infrastructure finance.

Understand project versus corporate finance.

Finance, value and structure large- scale infrastructure projects.

Analyse project risks and rewards.

Optimally restructure projects in distress.

Understand public-private partnerships (PPP) and private finance initiatives (PFI).

Investigate project finance in emerging markets.

Visiting Professor of Finance

Academic Focus

Ramin Baghai is an Associate Professor of Finance at Stockholm School of Economics (SSE). His research focuses on topics related to corporate credit markets, asset management, and topics at the intersection of labor economics and finance.

Experience

Ramin earned Master’s degrees at the London School of Economics and the London Business School, and a PhD in Finance from the London Business School. He is also a Research Affiliate at the Center for Economic and Policy Research (CEPR) and a Research Member at the European Corporate Governance Institute (ECGI). Ramin has published his work in top academic journals, such as the Journal of Finance, the Journal of Financial Economics, and the Review of Financial Studies.

Ramin has taught on a variety of programmes, including in the Executive Education area and MBA programmes. In 2020, he received the (student-elected) Best Teacher Award at the SSE.

This programme can also be taken as part of the Certificate in Finance. Gain the knowledge and tools to build expertise in finance. Customise your learning by selecting four courses from our extensive, world-class portfolio.

Submit your application through our online application form.

Not ready to apply yet? Reserve a place

Whether you are an individual or an organisation/group looking for a programme, get in touch and we can help find the best solution for you.