"My insatiable appetite for learning has brought me back again and again."

Finance for Non-Finance Executives

Demystify finance. Make sense of financial concepts and apply your new-found knowledge with confidence

Watch programme video

Please enter a keyword and click the arrow to search the site

Or explore one of the areas below

Gain practical finance skills. Become financially fluent, mastering key aspects of accounting and corporate finance in just one week.

Become proficient in financial language and terminology – communicate knowledgably and with confidence at all levels.

Gain a strong grasp of best practice corporate financial management, grounded within the context of your everyday decisions.

Develop the skills to prepare budgets and forecasts for operations and develop models that answer short-run 'what-if' questions.

Discover how to analyse and benchmark your company’s financial performance.

Use discounted cash-flow principles and net present value (NPV) techniques to perform successful project appraisals.

Make informed, valuable contributions to board-level discussions with new expertise and a deeper understanding of financial reports.

Develop the critical finance skills to accurately identify future problems – and successfully exploit new opportunities.

of professional experience

on average

industries

on average per cohort

Attendees include:

CEOs.

Managing directors.

Senior managers responsible for business units or for delivering company growth and shareholder value.

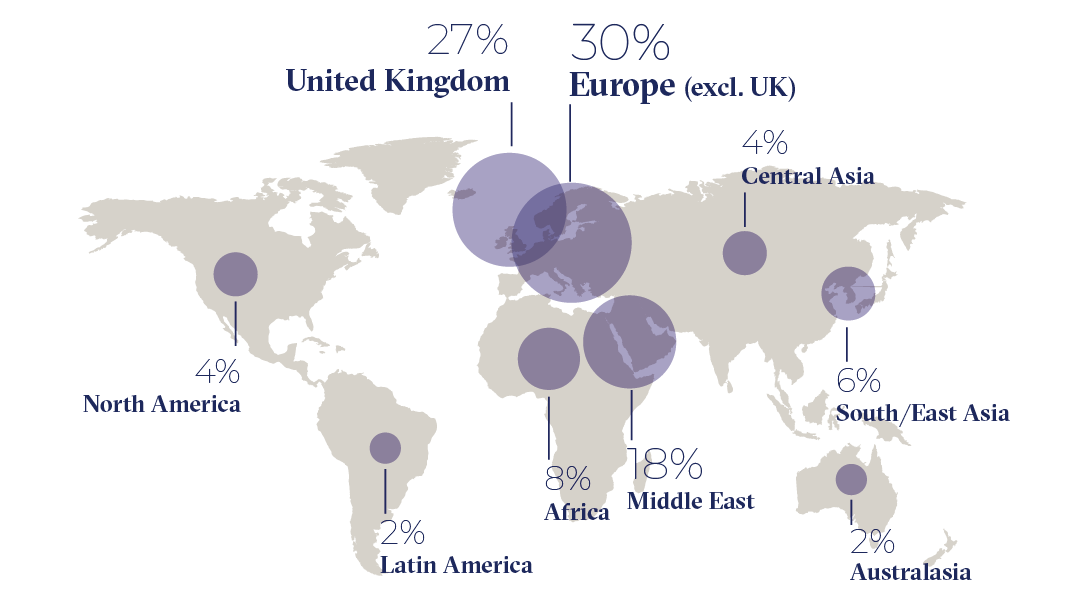

The data above displays the top nationalities and top 10 industries across a three year average of participants on this programme.

Demystify your financial accounts, unlock your company’s full potential and apply your new-found financial knowledge in a senior management context.

Improve your analytical perspective and change the way you look at financial data. Focus on three key themes of financial management:

Interpret company accounts – decipher them and discover what balance sheets and income statements reveal about your company’s performance.

Use accounting for management decisions – make confident decisions about your organisation’s future, exploring financial performance, customer profitability, product and service costs, and project appraisals.

Analyse shareholder value – give your strategic decision-making a boost, exploring company valuation, risk and return, and performance measures.

This programme can also be taken as part of the Certificate in Finance. Gain the knowledge and tools to build expertise in finance. Customise your learning by selecting four courses from our extensive, world-class portfolio.

Not ready to apply yet? Reserve a place

Submit your application through our online application form.

Whether you are an individual or an organisation/group looking for a programme, get in touch and we can help find the best solution for you.