"This programme hits home that you need to question everything."

Financial Strategies for Value Creation

Learn to create value through funding options, risk management and restructuring strategies.

Watch programme video

Please enter a keyword and click the arrow to search the site

Or explore one of the areas below

Discover the financial strategies behind some of the world’s most successful companies. Sharpen your thinking and increase your impact.

Learn to make the right strategic decisions at the right time.

Gain practical tools to create value based on your debt/equity mix.

Broaden your knowledge and develop confidence with an in-depth understanding of different restructuring and funding options.

Make smarter financial decisions through a better understanding of the practical application of risk management.

Undertake long-term financial planning. Explore research evidence and find out how - and when - stock prices respond.

of professional experience

on average

industries

on average per cohort

Attendees include:

Investment bankers.

Financial advisors.

Consultants.

Corporate managers in various industries.

Chief financial officers.

Board members.

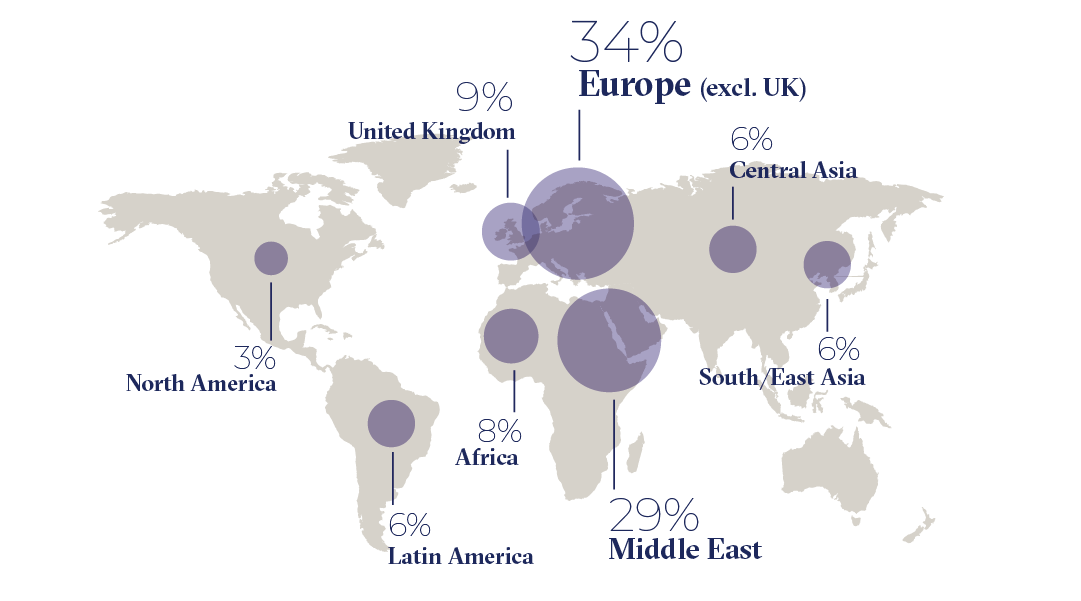

The data above displays the top nationalities and top 10 industries across a three year average of participants on this programme.

Master the practicalities of risk management. Understand funding options and explore restructuring. Make an immediate impact.

Learn to structure debt in terms of maturity, fixed/floating mix, and currency mix.

Focus on the application of derivatives in a corporate finance setting – real options, risk management and optimal gearing.

Discover how to return excess funds to shareholders, considering payout policy and merger motives.

Investigate corporate restructuring and find ways of resolving financial distress through IPOs and long-term financial planning.

Richard Brealey Term Chair Professor of Corporate Governance and Professor of Finance

Academic Focus

Professor Henri Servaes is the Academic Director for this programme. He consults for leading companies and featured in the Financial Times’s ‘Gurus of the Future’ series.

Recent Clients

Professor Henri Servaes consults and provides executive education for Anglo American, Barclays, Bertelsmann, Continental, Deutsche Bank, E.ON, the FT (Lex Team), Freshfields, PricewaterhouseCoopers, Suez and more.

Experience

This programme can also be taken as part of the Certificate in Finance. Gain the knowledge and tools to build expertise in finance. Customise your learning by selecting four courses from our extensive, world-class portfolio.

Submit your application through our online application form.

Not ready to apply yet? Reserve a place

Whether you are an individual or an organisation/group looking for a programme, get in touch and we can help find the best solution for you.