"I was instantly able to relate my work to the key aspects, theories and tools from the programme."

Mergers and Acquisitions - Dubai

Maximise the long-term returns from merger and acquisition deals and boost shareholder value.

Please enter a keyword and click the arrow to search the site

Or explore one of the areas below

Leverage value at every stage, from targeting to post-integration.

Explore the role of mergers and acquisitions (M&A) within your corporate strategy.

Learn to assess targets realistically, value target companies, assess bid tactics and avoid common pitfalls.

Manage cultural and system challenges arising post-acquisition, and understand key drivers for on-going success.

Successfully complete post-acquisition integration to generate maximum long-term value from the merger.

Gain the global perspective and knowledge needed to tackle M&A anywhere in the world, based on cutting-edge research from faculty with first-hand experience of acquisitions in the Middle East.

management experience

on average

nationalities

on average per cohort

Attendees include:

Professionals in roles that deal with M&A in any industry. Relevant to M&A first-timers or seasoned acquirers.

Buy-side or sell-side professionals wanting insights to successfully navigate deals.

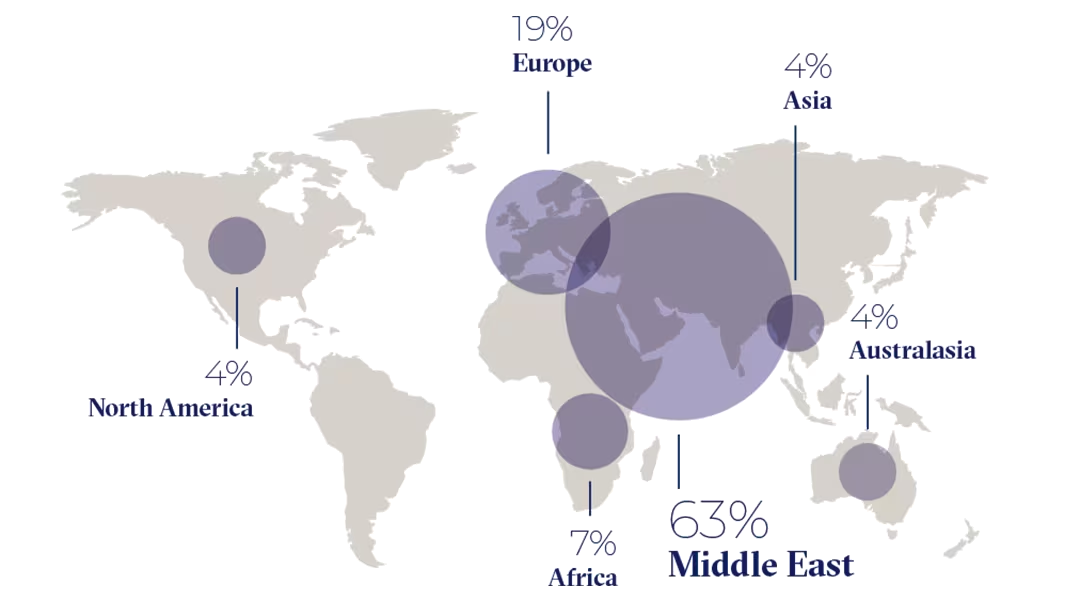

The data above displays the top nationalities and top 10 industries across a three year average of participants on this programme.

From the initial financial valuation, to leveraging your strengths and securing the best possible deal – acquire key skills that work for both you and your company

This programme can also be taken as part of the Certificate in Management. Enhance your leadership approach, hone your business skills and curate your own curriculum with a blend of online and in-person learning.

Submit your application through our online application form.

Not ready to apply yet? Reserve a place

Whether you are an individual or an organisation/group looking for a programme, get in touch and we can help find the best solution for you.